“From many come just a few.”

When an industry is born, it quickly becomes crowded with competitors. But after a short while, only the strong survive.

Just look at the U.S. auto industry. Almost 3,000 auto companies have started — and failed — in this country. Even at the turn of the 20th century, there were still more than 1,000 auto manufacturers in the U.S.

Many of them were jumping into the business because they believed that Americans would buy any car that was put out. At the time, people were buying so many cars that industry experts were expecting sales of 6 million cars a year during the 1920s.

But none of that happened. And hundreds of car manufacturers started falling by the wayside. Only the strongest ones survived.

And then, there were just three at the top…

In the 1920s, Ford, General Motors and Chrysler dominated the industry. And for the next century, the so-called Big Three accounted for 70% of U.S. auto sales.

I’m sharing this example with you today because it offers investors a big opportunity.

If you can identify the two or three companies like this that’ll dominate the market, you can make a lot of money…

How to Become King of the Hill

This process of consolidation isn’t unique to the auto industry. Far from it.

People are always trying to strike it rich. So when an industry is in its infancy, everyone and their mother-in-law throws their hat into the ring to get a piece of the pie.

That’s how hundreds — and many times, thousands — of companies start out: competing for market share.

But as the industry matures, most of these new companies become defunct for various reasons. Bankruptcy, phaseouts, mergers … take your pick.

At the end of the day, only a few companies survive and thrive. And this holds true for almost every industry.

For example:

- JPMorgan Chase, Bank of America and Wells Fargo are the three largest banks by deposits. They hold roughly 30% of the market, while no other bank has more than a 5% share.

- Google and Facebook have more than 50% of the market share for digital advertising.

- Home Depot and Lowe’s have a combined 85% share of the retail home improvement market.

You can take a look at any market, and you’ll see that only a handful of companies have captured the majority of the share.

These are the companies that have attracted most of the capital. This allows them to grow bigger and faster than the competition. It’s how they eventually become king of the hill.

And investors who are able to identify and invest in these dominant players are able to make outstanding returns in a very short time…

Which Industries Are Next?

Take Google and Facebook.

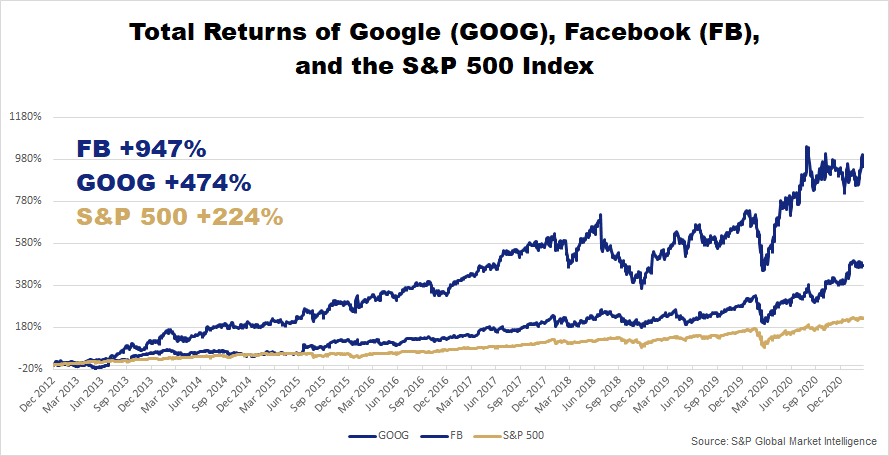

If you’d put just $1,000 into each of them a little more than eight years ago, your total investment would have increased sevenfold. The same $1,000 invested in the S&P 500 Index wouldn’t have gone nearly that high.

Now, the key is being able to find these leaders in the early innings of the industry’s growth.

For everyday investors, that’s not always obvious. But that’s why my team and I do the heavy lifting for you.

With nearly 40 years of investing experience on Wall Street, I know which industries to look for: growing ones with strong tailwinds pushing them higher.

And the industries I’m seeing today that fit these criteria are in two sectors: health care and technology. Both are seeing unprecedented levels of new innovation. The companies leading the pack in these new developments will be the ones to hand investors a windfall.

Of course, you can always gain broad exposure to these industries through the Vanguard Health Care Index Fund ETF (NYSE: VHT) and the Vanguard Information Technology Index Fund ETF (NYSE: VGT).

These exchange-traded funds (ETFs) hold a basket of top health care and tech stocks, respectively.

But the best profits won’t come from these funds. They’ll come from specific industry leaders paving the way for new innovation. And I’ve found several of them during my research recently.

I shared one of them just last week in the April newsletter of my Alpha Investor service. This company is in a thriving $86 billion section of the technology market that my subscribers have already started profiting from.

And the way I see it, this new recommendation will not only survive the competition, but thrive, too. This leader is now trading at a bargain price. So, it’s a great time to buy into it. But this might not be the case for long. To find out how you can sign up to get a piece of the action, click right here.

Regards,

Founder, Alpha Investor